One Of The Ten Most Financially Stressed Cites Is In North Carolina

If you aren’t feeling financially stressed then I want to be in the tax bracket that you are in. With surging prices on seemingly everything from groceries to rent to everyday necessities many Americans are struggling to make ends meet. Signs and some experts are predicting a recession coming soon. (Because I needed more stress in my daily life). And I’m not alone many of us are experiencing financial stress. New research from our friends at Raisin’s’ Financial Health study delved into American finances and American’s knowledge of the topic. An interesting fact that they shared with us is that a quarter of Americans identify themselves as “financially unstable”.

Financial Stress Is Impacting America

Nearly half of Americans report cutting costs as a way to improve their financial health in 2023. Data comes from a Raisin study of around 4,000 people in the United States. The purpose of the study was to “explore people’s relationships with money, including habits, financial knowledge, and emotional connection.” Many Americans are less than educated on this matter. This absolutely should concern you. The findings show that 51% of those surveyed are “clueless” when it comes to inflation. Additionally, 58% reported a lack of knowledge regarding what a recession entails while 55% do not understand interest rates.

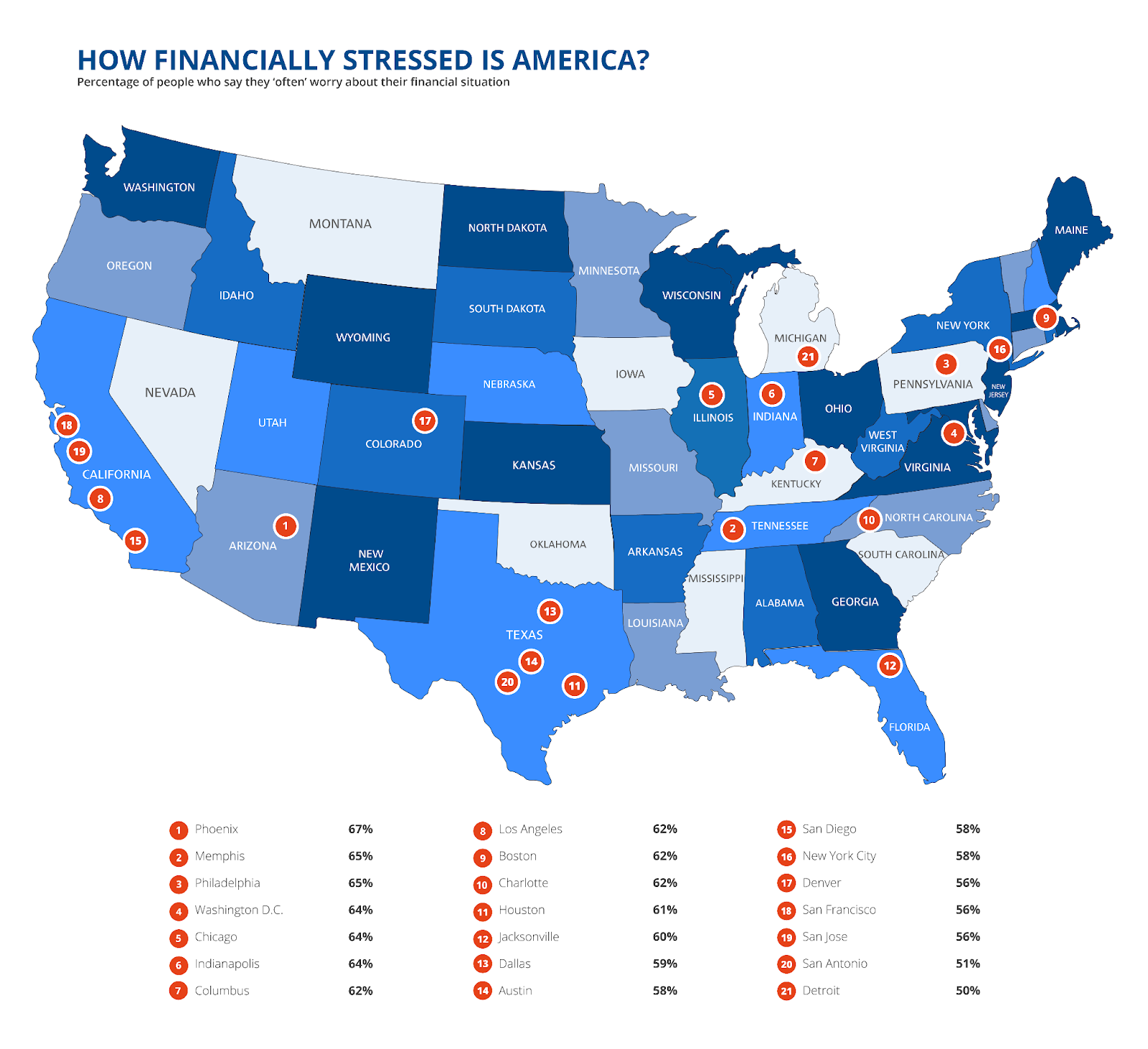

They also created a ranking of cities that reported they were the most financially stressed. And it was Charlotte, NC that ranked 10th on this list. The irony of Charlotte being a banking/finance hub (the second largest in the country outside of NYC) is not lost on me. Not only are Charlotte residents’ finances impacted by financial stress, but many of their careers are tied to a healthy economy. Financial struggles can also lead to significant emotional and physical distress for many adults. 50% of survey respondents said that they “frequently experience hopelessness, despair, and physical symptoms like headaches” due to financial stress.

I wish that things were different and that these struggles were not ones that anyone had to endure. But at least we aren’t alone Charlotte. I’d just like to be in a tax bracket where my living expenses are only 50% of even better a third of my income. And I can not feel bad about buying fresh flowers at the grocery store. Is that too much to ask? You can see a map of the most financially stressed cities below. Get more info from Raisin’s study here.